The global data center liquid cooling market is projected to grow from USD 2.6 billion in 2023 to USD 7.8 billion by 2028, at a CAGR of 24.4% during the forecast period. [2]The market growth is driven by the increasing need for compact and efficient cooling solutions due to the rise of edge computing and Internet of Things (IoT) devices. This type of cooling is particularly beneficial in remote areas and challenging conditions, supporting data handling and cooling of small form factor devices and edge servers.

Figure 1: Data Center Liquid Cooling Technology Usage Example [1]

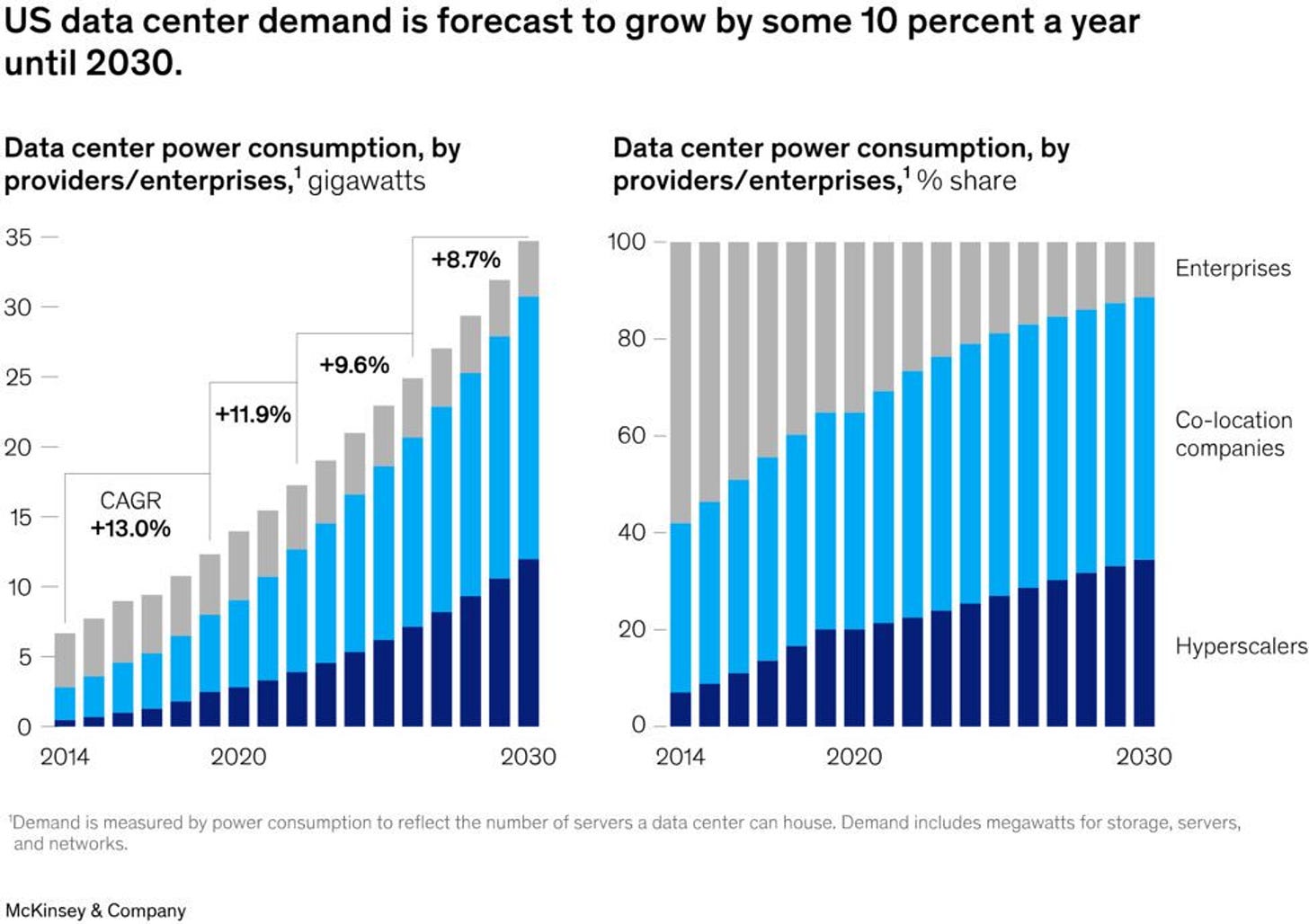

Figure 2: US data center demand forecast [3]

There are approximately 10,978 data center locations worldwide as of December 2023. [4] As of March 2024, the United States had 5,388 data centers, which is more than any other country in the world. [4] This means around half of the world’s data centers are based in the USA.

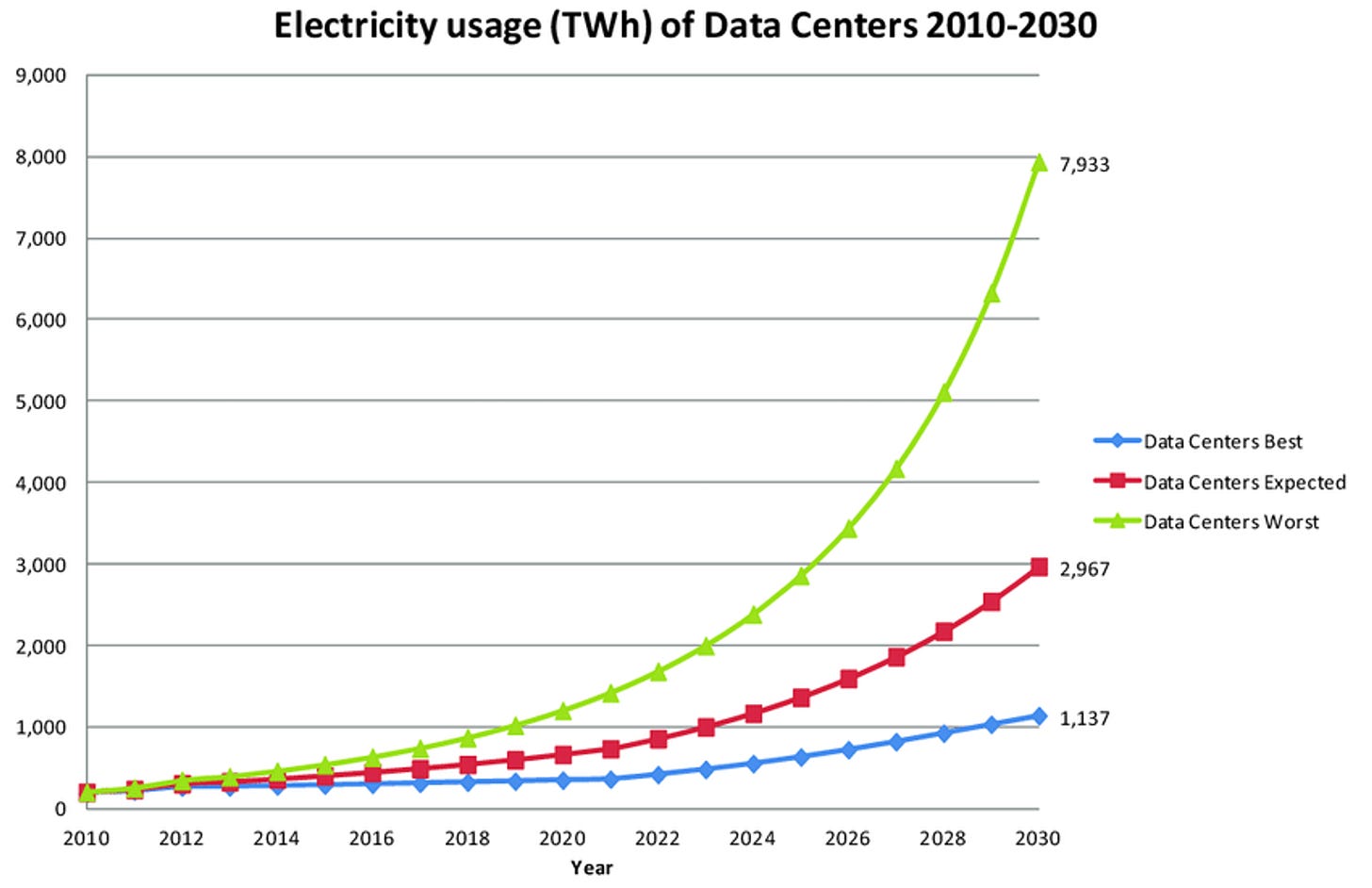

The average Data Center consumes as much energy as 25,000 homes. [5] Data centers consumed 7.4 Gigawatts of power in 2023 world wide, a 55% increase from the 4.9 Gigawatts in 2022. [4] In the US, consumption is expected to rise from 200TWh in 2022 to 260TWh in 2026, some six percent of all power use across the country. [6]

Figure 3: Data center electricity usage forecast [3]

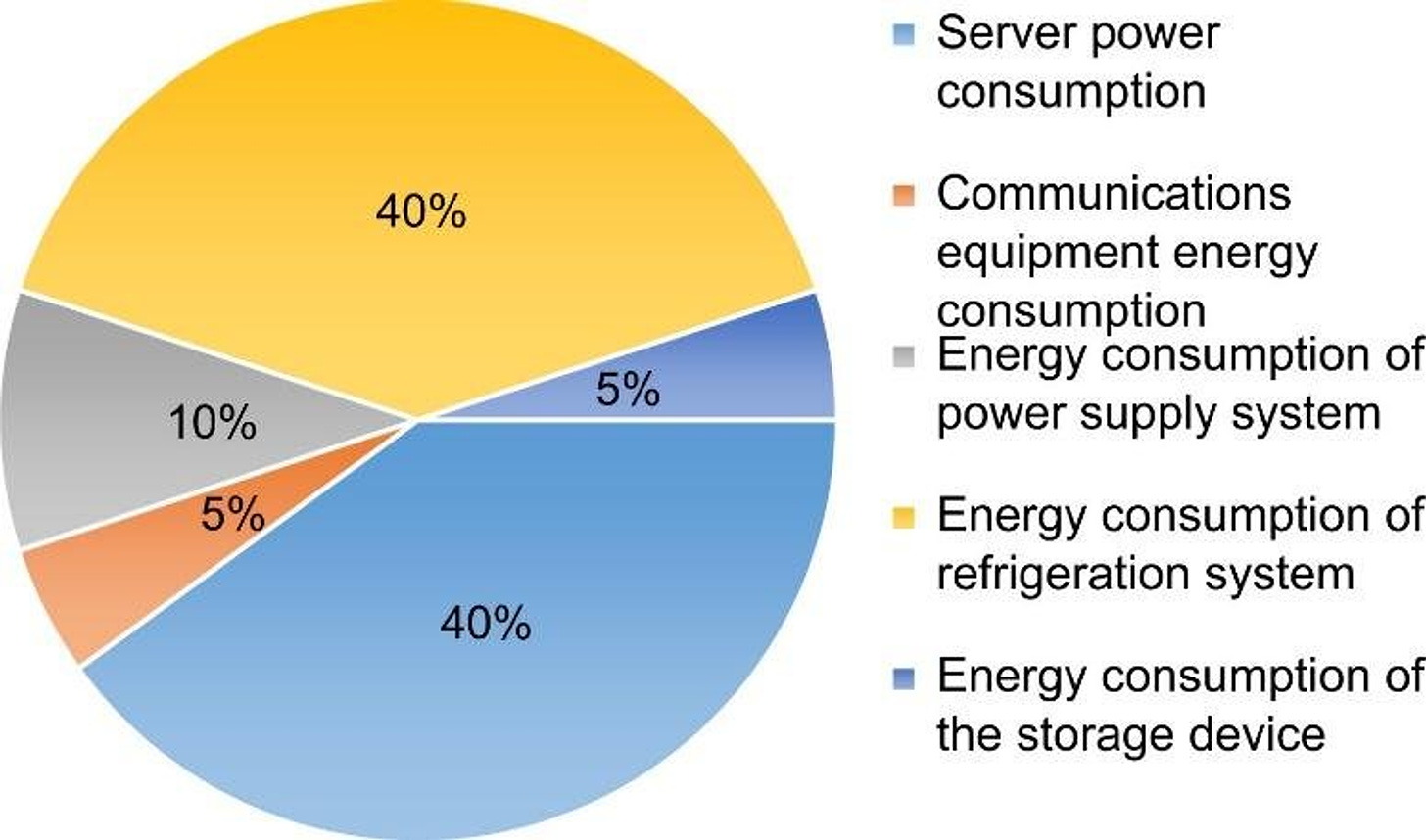

The rapid growth in the number of data centers, combined with their high energy consumption, is likely to prompt stricter regulatory compliance requirements to address the urgent energy issues. With cooling systems typically accounting for 40% of energy consumption in a traditional air cooled data center, more efficient data center cooling solutions are becoming increasingly important.

Figure 4: Typical breakdown of energy consumption in air- cooled data centers [7]