The low recycling rates of lithium-ion batteries can be attributed to several key factors:

- Complexity and Cost: The recycling process for lithium-ion batteries is technically complex and costly due to the need to safely handle and disassemble batteries containing hazardous materials. The diversity in lithium battery chemistries and designs further complicates the recycling process, requiring specific methods to efficiently recover valuable materials. This variability necessitates sophisticated sorting and processing technologies, which increase the complexity and cost of recycling operations. Additionally, the high capital expenditures (capex) and operational expenses (opex) required for current recycling technologies create substantial barriers to entry, limiting the number of viable market players.

- Lack of Infrastructure: There is a lack of widespread, established recycling infrastructure and technology specific to lithium-ion batteries. Establishing a recycling facility requires significant investment to handle hazardous materials and meet stringent environmental regulations. High entry barriers also exist due to the need for economies of scale and the challenge of scale-up with varying scrap rates from different cell and cathode manufacturers. As a result, only a limited number of facilities exist globally, contributing to low recycling rates.

- Economic Incentives: Fluctuating prices for raw materials recovered from recycled batteries can deter investments in recycling technologies. Since these materials constitute only a small fraction of the overall precious metals industry, the pricing power for battery recycling businesses remains limited. Additionally, the inconsistency in the quality of recycled materials hinders their use in high-performance applications like electric vehicles. Uncertainty due to challenges in material recovery costs and the absence of a sustainability premium further discourage investment in recycling technologies.

- Large Number of Competitors: With over 30 recycling projects already announced in the EU alone, the market is highly competitive. This creates a narrow window of opportunity for new entrants. Traditional recyclers, cell manufacturers, and auto OEMs are all competing to capture market share and lead the energy transition, which can dilute the potential benefits of early investments in recycling technologies.

- Alternatives at End of Life: Second-life applications for batteries, such as repurposing for energy storage systems, delay the time at which batteries can be recycled. Additionally, disparate hazardous waste regulations across markets complicate the disposal and recycling process, especially for battery chemistries using lower-value materials.

- Bargaining Power of Buyers and Suppliers: The refined materials markets are dominated by a few players, such as cathode manufacturers or integrated cell manufacturers, giving buyers higher bargaining power. Suppliers also have significant leverage as the highest volume of feedstock comes from cell scrap of cell manufacturers, which is a highly concentrated market. The concentration of cell manufacturing and its proximity to suppliers helps reduce transportation costs but creates dependencies that impact the recycling supply chain.

- Collection Challenges: Efficiently collecting spent batteries from consumers and businesses poses significant logistical challenges, resulting in many batteries not being recycled. The costs associated with transporting devices containing batteries and dismantling them are some of the largest expenses for lithium battery recycling companies, adding to the complexity and cost of the recycling process.

- Regulatory Framework: Inconsistent regulations and standards across regions impede the development of a global recycling network. Although current regulatory incentives, such as U.S. federal grants and tax credits, are beneficial, they may not be sufficient to drive widespread recycling practices. More robust and specifically targeted incentives might be necessary to spur investments in recycling technologies and infrastructure, ensuring that recycling becomes an integral part of battery lifecycle management.

Addressing these challenges requires technological advancements, improved economic incentives, and stronger regulatory frameworks to enhance the recycling rates of lithium-ion batteries.

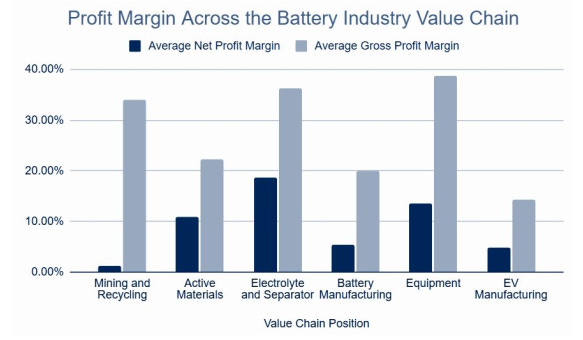

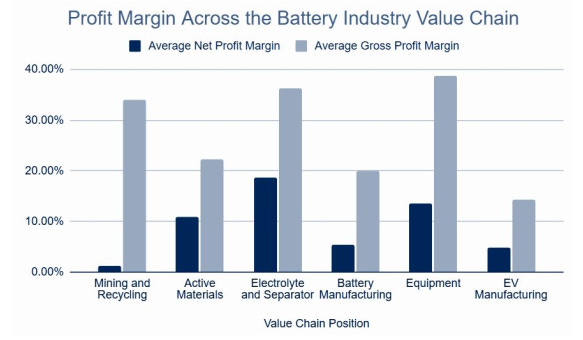

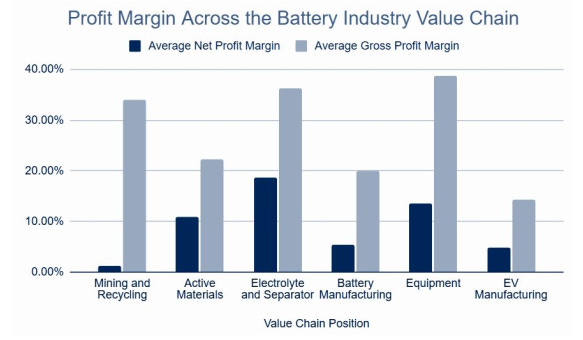

Figure 6: Mining & recycling companies enjoy higher gross profit margins due to lower Cost of Goods Sold. However, they have low net profit margins due to high operating expenses (e.g. high upfront capex, licensing, permitting). [11]